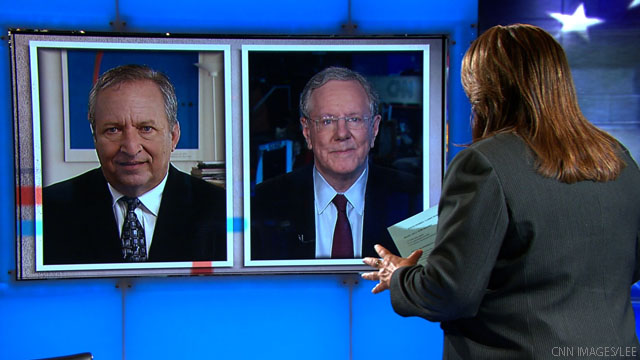

Summers and Forbes on S&P Dowgrade

Today on CNN’s State of the Union with Candy Crowley, Candy spoke with Larry Summers, former director of the National Economic Council under President Barack Obama and Steve Forbes, CEO of Forbes, Inc. about the downgrade of the United States’ credit rating. A full transcript of State of the Union with Candy Crowley is posted on CNN.com. A highlight from the interview is after the jump and this interview will re-air at noon ET.

EMBEDDABLE VIDEO: http://cnn.com/video/data/2.0/video/politics/2011/08/07/sotu.summers.debt.cnn.html

Highlight from Interview

THIS IS A RUSH FDCH TRANSCRIPT. THIS COPY MAY NOT BE IN ITS FINAL FORM AND MAY BE UPDATED

CANDY CROWLEY, CNN ANCHOR: I can’t think of two men better to try and explain to me what to make of the downgrading of the U.S. government’s credit rating. Let’s start with you, Steve.

STEVE FORBES, PRES. AND CEO, FORBES INC.: Well, I think in a narrow sense, it is a political move, and I think it’s really — it’ll sound strange for me to say it, an outrageous move. The government can pay its debts, it’s legally obligated to do so. It’s got the wherewithal to do it. In a larger sense about the economy, I think the U.S. economy is in a perilous state. This recovery has been the worst from a severe recession since the Great Depression, but I am surprised S&P would play politics. The U.S. government can pay the interest and principle on the bounds.

But in a broader sense, we do have severe economic troubles but will be able to pay the interest and the principle on the bounds.

CROWLEY: Larry, I’m going to have to believe that you’re going to agree with him, because I have heard this weekend from any number of administrative officials pushing back so hard against this, talking about how amateurish it was, that S&P is looking for its 15 minutes of fame. They really think that this was an unjust move.

Give me your take on why you think S&P did this. And do you agree with that?

LARRY SUMMERS, FORMER DIRECTOR, NATIONAL ECONOMIC COUNCIL: Look, S&P’s track record has been terrible, and as we have seen this weekend, its a arithmetic is worse. So, there’s nothing good to say about what they’ve done.

But that’s not the large issue here. The large issue here is that the House majority played chicken with America’s credit worthiness, and America’s families are going to be the losers, losers in terms of higher interest rates on their mortgages, losers in terms of what this is going to mean for employment, that we’ve got critical economic problems. The critical economic problem of slow growth and lack of jobs, the critical economic problem of a long-run budget situation that needs to be adjusted and needs to be adjusted in a rational way, and we have to find balanced approached going forward. Balanced approaches to focus on the jobs deficit.

###